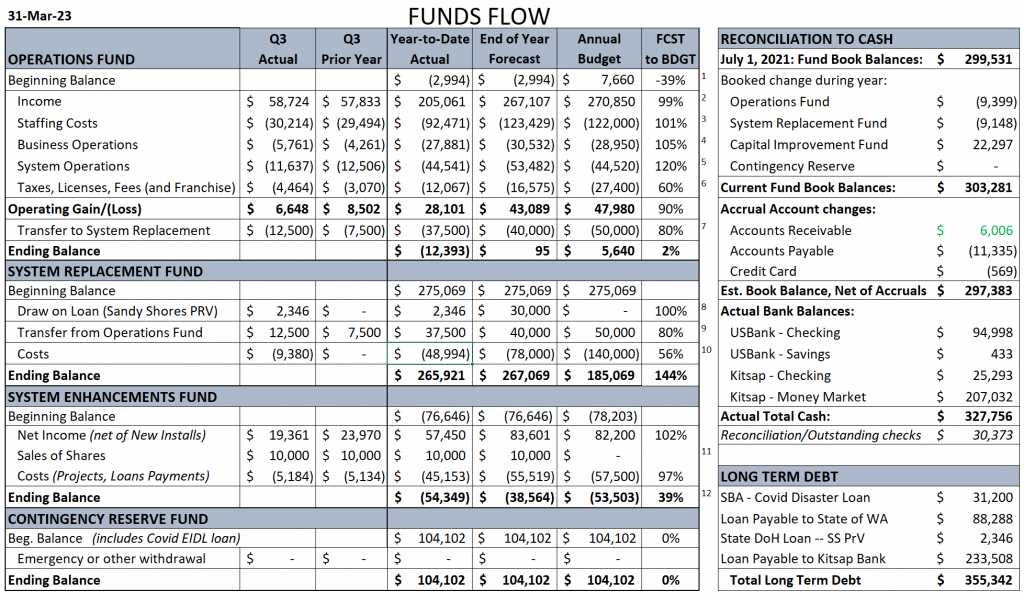

Nice to have a cool, rainy afternoon to produce the quarterly report! No surprises but with Operations income a bit lighter than budgeted vs slightly higher costs, we will be closer to break-even than planned and may need to reduce our transfer to the Replacements Fund to $40,000, instead of $50,000. Fortunately, the Replacement Fund will do well, in any case, as we’ve held back on the “Summerhurst Connection” and early costs for the Sandy Shores PRV relocation are paid via draws on the loan recently extended by the State of WA (Dept of Health, Water Department).

The Financial Summary includes a Forecast for how we may finish our Fiscal Year (July – June). We generate a Forecast during the budgeting process and here we report how that Forecast compares to our established Budget. The additional notes below relate to the numbered items in the report.

COMMENTS:

— #1: We began the year with a lower (even negative) balance than anticipated due to accelerated work on the Small Water System Management.

— #2: Billings are just slightly below Budget, as Water Usage was lower in mid-winter than previous years.

— #3: Staffing costs just slightly higher than expected.

— #4: BizOps slightly over budget as we under-budgeted the Insurance costs. (We have a better handle on this for next year’s budget.)

— #5: SysOps is over budget by 20% due to Energy, Chlorine and Quality Testing costs plus consulting for Hydrologic (pressure) measurements for the SWSMP, cleaning the water tanks and unanticipated removal of some nuisance trees.

— #6: We are not expecting to pay out a Franchise Fee to King County, again this year. (And remain unsure of what any eventual payments may be.)

— #7: As mentioned above, we may need to transfer less to the Replacement Fund than budgeted. (Last year our transfer was $30,000.)

— #8: We have incurred our first engineering costs for the Sandy Shores PRV Relocation project and made the firs draw on our “Pre-Construction Loan”. The $30k in forecast borrowing implies that we’ll have $30k in costs this year. We will only borrow in line with actual costs.

— #9: Again, this reflects the transfer from Operations

— #10: Replacement Project Costs are lower than planned as we have delayed any startup on the “Summerhurst Connection” and will spend less on PRV relocation than budgeted for this year.

— #11: We sold a new membership with its associated share from our remaining allotment. (For many years, new members have purchased their shares from members that have returned their shares, so it’s been fairly rare for Dockton Water to receive capital from a new member.)

— #12: Primarily thanks to the sale of that share, our Capital Improvement Fund is getting a 39% boost from what we budgeted.

Detail Reports From Quickbooks:

Contact me with any questions/comments: Todd, 206-696-1216, twcurrie@yahoo.com