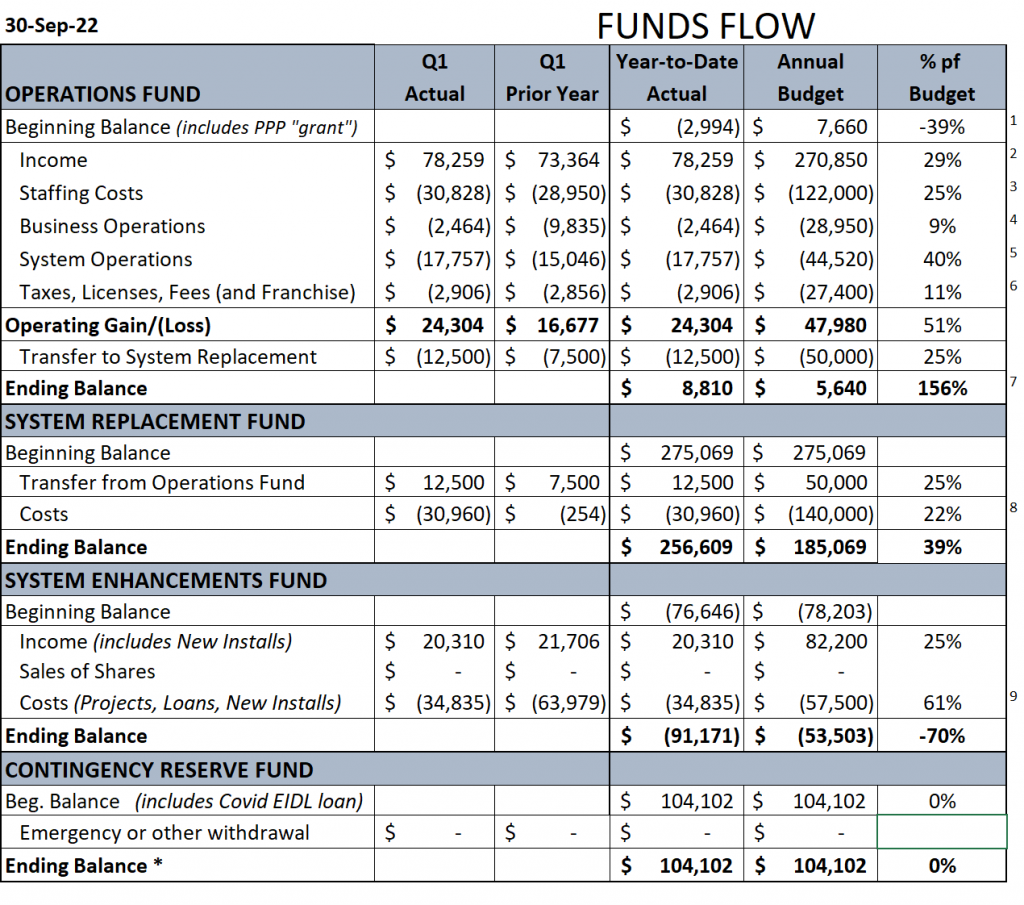

No big surprises in Q1. We are starting to see the impact of the rate change (increased revenue vs prior year). See superscript numbers and related comments below for more insights.

COMMENTS:

— #1: beginning balance in Operations Fund is lower than budget primarily due to an additional billing for the Small Water System Management Plan we were able to accomplish in prior year.

— #2: Income is above prior year due to rate increase. Big impact has only come with Sept billing (for August usage.) Important to get ahead of Annual Budget (currently at 29% vs 25% for a quarter year) with our high summer billings.

— #3: Staffing costs, at 25% of annual budget are as expected. (Slightly higher that prior year.)

— #4: Business Ops costs are way below prior year (no legal bills). They are lower than budget because Insurance has not yet been billed — that’s the biggest single Business Ops expense.

— #5: Systems Ops are high vs Prior Year and Budget, primarily due to cost to clean tanks (which we will include in the budget, next time) and water testing (chemicals) and energy are costing more.

— #6: As usual, Taxes are low vs Budget because we budget for King County franchise fee but no fee is yet defined or due.

— #7: For Operations Fund, our current balance is higher than our expected end-of-year balance. We want to be well ahead before cash-negative months of winter and early spring.

— #8: System Replacement costs are primarily for the work completed on the “old schoolhouse”, plus some meter replacements. (Just think what these cost would have been if we had paid for the painting!) ;>)

— #9: System Enhancement costs are almost exclusively payments on our long-existing state loan, which we pay once/year. (We are using System Enhancement funds only for servicing loans on past capital projects, this year.)

This quarter we also submitted an application for a new loan from the State for the advance work of the Sandy Shores PRV replacement project. This loan, if we are successful, is well within our means for financing. And, we will have greatly “upped-our-game” in terms of operational management in order to qualify for a loan. We now need to look seriously at the challenge to fund/service the monies needed for the actual completion of the project, as well as our long-term CIP planning.

Detail Reports from Quickbooks:

Contact me with any questions/comments: Todd, 206-696-1216, twcurrie@twcurrie