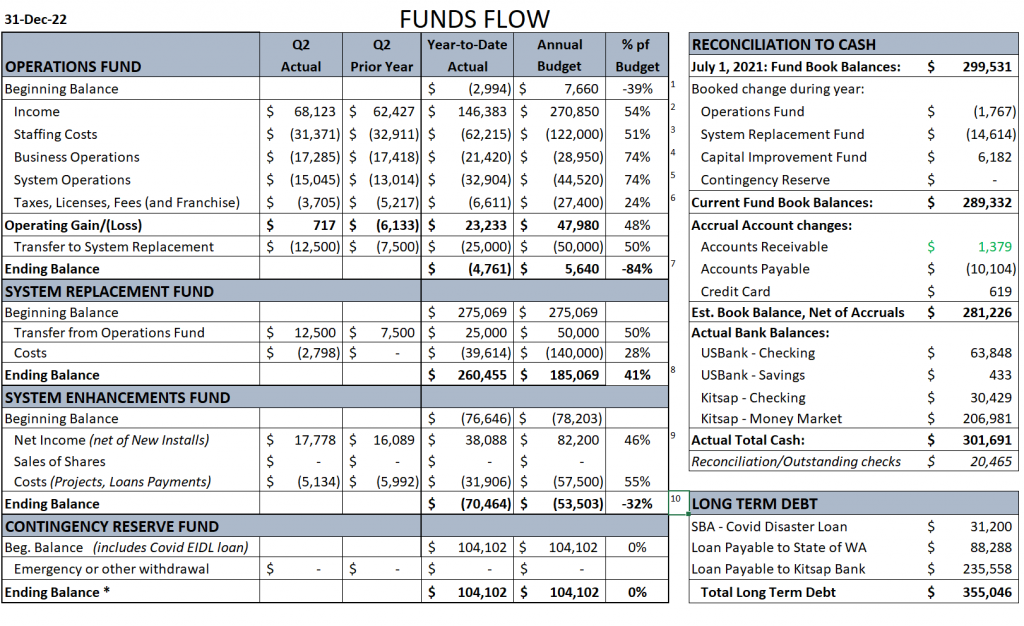

We are about where we’d expect to be halfway through the year. Comments below correspond to numbered items in the Funds Report.

COMMENTS:

— #1: beginning balance in Operations Fund is lower than budget primarily due to an additional billing for the Small Water System Management Plan booked at the very end of June.

— #2: Income still running slightly ahead, due to summer billings.

— #3: Staffing costs are on target at 51% for half the year.

— #4: A bit alarming that BizOps costs are already at 74%, but this is due to Insurance — our biggest office cost — being paid for the year. Due to our update of asset values and coverage plus a cost increase, Insurance was 30% higher than budgeted. This keeps pressure on the BizOps budget for the rest of the year but we are expecting lower legal costs than budgeted to help offset.

— #5: Systems Ops is also running hot at 74% of annual budget! This is primarily due to the cost to clean the water towers and purchase of spare parts and a tool for measuring water pressure (which will save us the higher costs of hiring an outside firm.) This pressure testing is required for our Small Water System Plan. We are also seeing much higher costs for energy, water quality testing, and fuel for the truck. Dave is very attentive to costs, managing things tightly and we will be increasingly cash positive through the end of the year. As with BizOps, SysOps will finish the year over budget, but by 10% or less (barring any significant maintenance issues.)

— #6: As usual, Taxes are low vs Budget because we budget for King County franchise fee but no fee is yet defined or due.

— #7: Our deficit in the Operating Fund has increased a bit. This should recuperate through the end of the year to finish similar to last year. (Meaning, this year’s income and costs should finish break even.) Perhaps the largest variable is, as always, the unknown impact of any Franchise Fee determination with the County. (No new developments, at this time.)

— #8: System Replacement fund is fairly flush right now and will remain so. The only anticipated remaining costs (Pre-construction engineering for the Sandy Shores PRV relocation) will be funded via the loan approval we’ve received from the Dept. of Drinking Water, WA Dept. of Health.

— #9 and #10: System Enhancement (aka Capital Improvements) inflows are close to what we expect — from Reserve Account Base fees and Capital Charges. We’ve paid the bulk of our loan servicing for the year. So, with no anticipated costs (investments) this Spring we can anticipate that we will reduce the carry-over deficit even more than budgeted, ending the year closer to -$40k, which is good incremental improvement.

In summary — both our revenue and our costs have been front-loaded, this year. Even though revenues are a bit lower in the second half (Water Usage income drops, other billing items remain fixed) we anticipate much lower costs and “coasting” to a reasonable finish, but it will be tight!

Detail Reports From Quickbooks:

December-2022-2nd-Qtr-Funds-Flow-vs-Budget

December-2022-2nd-Qtr-Funds-Flow-vs-Prior-Year-1

Contact me with any questions/comments: Todd, 206-696-1216, twcurrie@yahoo.com